2024 Vs 2025

Should I Buy a House Now? The Timeline Of The Housing Market

Buying a new house is a rollercoaster ride and catching just the right wave at the right time can help you land the home of your dreams. So as we enter 2024, I know you are asking yourself whether you should go ahead or wait until 2025. I know, trust me, I've been there. It's not just about the numbers and the forecasts; your own financial circumstances, life goals and risk tolerance are all considerations in making this big decision. In order to clear things up a bit, this is a guide that will allow you to understand all the most important aspects, so you can go plan your move with confidence.

Reddit Answers: Raw People, Direct Insights

Reddit is just a gold mine of honest-to-God people just sharing their stories. Look at the Reddit thread, Who else waiting to purchase until 2025? to find out from people in the same predicament. Everyone's situation is different but I figured showing what others are thinking might be really beneficial.

Real Estate Market in 2024

Getting through real estate in 2024 is similar to and other land — there are surges, and there are tough situations, and you've got to know how to stay focused. High home prices, high interest rates, and regional markets beating to their own drum. Record books have tumbled in some areas with the biggest annual slide since 2012 (-0.5%) thanks also to mortgage rates dampening enthusiasm from some buyers,35% of whom bought their homes in cash at the peak in 2011. But don't be discouraged — that can be a good thing if you're a buyer. Zillow research shows that the direction of mortgage rates—up or down—drives the turnover of housing stock as homeowners decide whether to pace the bar for their next favorite couch on the site. The study discovered that interest rates would need to fall close to 4% to 5% in order for most of the homeowners locked into their low rates to be interested in selling and buying another home.

The Interest Rate Situation — What is It, and what does it Mean for You?

In real estate, interest rates are everything. By time of writing, they are stills at about 7% for a 30-year fixed mortgage with May 2024. This means the average home comes with a pretty heavy monthly payment, which is too bad for a lot of first-time potential homeowners. Perhaps the better news: rates will be less likely to spike further up or plunge more deeply down for the 2025 tax year. Everything we are living through suggests that a slow retreat would be better for the market than a rapid freefall. It would stop a massive wave of buyers that would easily surpass any inventory gains and just get everyone back into a heart-pounding bid-for-house frenzy. If those monthly payments are a big question mark for you, you may want to hang on before you do anything. Homebuying 101 Series — Mortgages & Homeowner Costs Explained

Supply versus Demand: Your Options in 2024 and Beyond

This makes all the difference in the world as to whether 2024 or 2025 is YOUR time to buy. Currently, we are somewhat limited with the number of homes for sale — in large part because so many homeowners remain locked in by those low rates, and not rushing to sell. However, one little glimmer of hope for buyers comes in the form of accelerating new home sales as builders continue to offer more affordable options to potential buyers. As a result of this building boom, those anticipating brand-new builds—especially if you're all about creating your own space—might make 2024 the year für you. Housing market forecasts 2024 — read about the prospects of the future From Business Insider — 2024: The expectations for those planning to buy a home. NBA…at this point it would be easier to ask how hard it is to buy a home By NBC News Home prices, interest rates, availability and more factor into our new metric, updated monthly, that gauges how difficult it is to buy a home where you live.

Over the course of 2024, most experts anticipate that home prices will continue to rise.

- Fannie Mae currently sees home prices rising 4.8% YoY by the end of 2024

- The Mortgage Bankers Association believes prices could rise as much as 4.1%

- The National Association of Realtors is slightly less bullish and sees prices rising by 1.7% for existing homes as a whole through the last quarter of 2024

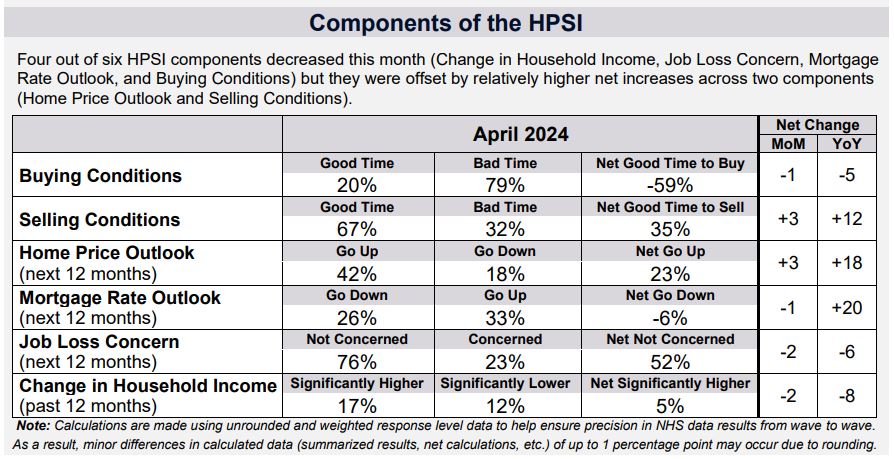

Source: Fannie Mae

Knowing Your Space (Location, Location, Location)

Location, location, location real estate is the practice of this maxim. Some of the things happening in those known bastions of busyness will show up as if they were on their way to your quiet suburb. Do your area-specific research like a boss — job growth, the local economy, and population it's usually a good place to start. In a hot market, it almost certainly makes sense to buy as soon as you can possibly move in to guarantee your place before prices rise even higher. A good real estate agent can be your secret weapon behind the scenes, telling you the market peculiarities that only insiders are aware of.

Home Ready Finances — Credit Review A Personalized Checklist

In all the madness of the market space talk, the wild card in your homebuying decision — assuming you stick to the earlier advice to avoid buying into more than you can buy out of or afford otherwise — is you. Down Payment and Savings If you haven't saved enough money for a good down payment, ask yourself these questions. And then riding: A bigger one means lower monthly payments, and maybe even an amount or interest rate that's more agreeable to your and your bank. Aim for 20% or higher to avoid that annoying private mortgage insurance. Credit History: How is your credit in-line? Better loan terms become available to you as your score climbs. Do what is necessary to increase it. Debt-to-Income Ratio (DTI) —Calculate your DTI to determine the maximum amount of house you can afford. The lower your DTI, the more flexibility you have and the more access you'll have to a great mortgage rate. Job Security: Does your income come at regular intervals? Lenders want to know you will be able to repay your loan so may not want to lend to you if you job hop. Are you Staying Put or Moving On in the Future? This could maybe make more sense if you can afford to be tied up in it for awhile so that those closing costs pay off, and you build some equity. Risk Tolerance – How well do market fluctuations sit with you? Expect 2025 when the market may be a bit less volatile — if you're not much of a risk-taker, that is.

As the saying goes, the heart wants what it wants: never, ever, ever ignoreyour gut

Homeownership is more about the feeling at the end of the day than it is about the dollars and cents. That emotional tug is strong. If you do find a home that meets all your main criteria in your price range, it may just be worth moving forward even when the market is not ideal. Of course trust your intuition, but marry that to your base common sense.

The Do’s and Don’ts of Buying a Home in 2024

- Stay in the Loop: Monitor the direction of the market and interest rate outlook.strictEqual(6) Knowledge is power!

- Work with an Agent: An experienced homeowner's guide in this rollercoaster of a market. They are the pros and can save you time and money and a headache.

- Pre-Approvals: This will show you what you can really afford and that you're serious to sellers.

- Exploiting All Possibilities: To avoid having to compromise, it never hurts to stop being demanding and open your search of neighbourhoods and styles of houses.

- Do not be in a Haste: Do not hurry to get something — be patient and get a proper home.

- Avoid the First Mortgage Offer: If you will obtain a mortgage, do not take the very first offer you get. Shop for the best rate and terms for you, from multiple lenders.

Verdict: Is 2024 Your Year to Buy?

The answer, to be honest, lies in your individual circumstances and proficiency in trading in the existing market. Admittedly, high rates and tight inventory are acting as challenges, but it is not all bad news as there are a few silver linings still out there, especially in areas where prices are falling and there is plenty of new construction coming on stream. If your finances are right and interest rates do not change and you find that dream home you have been looking for then 2024 could be your year. But, if you're feeling unsure, need the extra time to save, or would prefer to wait for what could be lower rates, 2025 might be a more suitable option.