Shop Around for a Mortgage: How to Find the Best Lender Offer

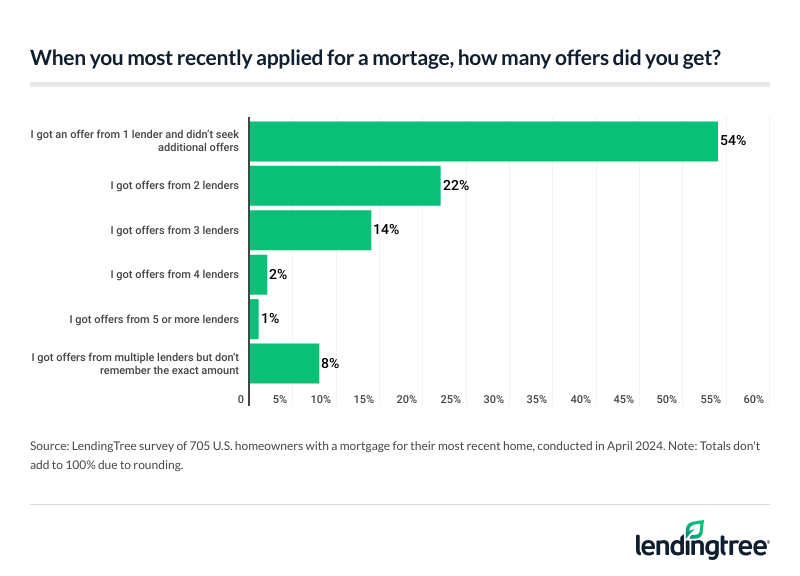

Buying a home is one of the most significant investments you'll make in your lifetime, and securing the right mortgage can save you thousands of dollars over the years. Believe it or not, a lot of people don't bother shopping around for their mortgage. According to a recent LendingTree study, 54% of buyers only get one mortgage offer. Imagine if you could save hundreds of dollars a month just by comparing a few more offers. Let's walk through why it's so important...

Why You Should Shop Around for a Mortgage

When you're in the market for a new home, it's easy to get caught up in the excitement and rush through the mortgage process. However, taking the time to compare multiple mortgage offers can have a significant financial impact. Here's why:

Potential Savings

A study by LendingTree found that 45% of those who shopped around for a mortgage received a lower offer than their initial quote. Different lenders have varying criteria and rates, meaning the first offer you get is unlikely to be the best one available. By comparing offers, you can ensure you're getting the lowest possible interest rate, which translates to lower monthly payments and substantial savings over the life of the loan.

When my wife and I decided to buy a bigger house, we went to our bank. We both had checking accounts, and I had a business account there also. They initially pre-approved us but started questioning and delaying the process when we were ready to buy because I am self-employed. Here is the crazy part. We both have over 800 credit scores and we had over 20% down payment. Our real estate agent put us in touch with a mortgage broker. After talking with the broker on the phone for 5 minutes, he said, "we have a deal as soon as our info checks out." We got approved the next day ;-)

Ever wonder how much you could save by comparing a few mortgage offers?

Variety of Loan Options

Different lenders offer different types of loans. While 30-year fixed-rate mortgages are popular, you might find that a 15-year mortgage or an adjustable-rate mortgage (ARM) better suits your financial situation. Additionally, government-backed loans like those from the Federal Housing Administration (FHA), U.S. Department of Agriculture (USDA), or Department of Veterans Affairs (VA) might offer better terms if you qualify.

Better Terms and Conditions

Beyond interest rates, shopping around allows you to compare other loan terms and conditions. These can include the size of the down payment, closing costs, prepayment penalties, and the overall flexibility of the loan. By comparing these aspects, you can find a lender whose terms align with your financial goals and circumstances.

How to Shop Around for a Mortgage

Now that you understand the importance of comparing mortgage offers, let's dive into the steps you can take to shop around effectively.

1. Understand Your Financial Situation

Before you start reaching out to lenders, it's crucial to have a clear understanding of your financial situation. This includes your credit score, debt-to-income ratio, and the amount of money you have saved for a down payment. Lenders will use this information to determine the types of loans you qualify for and the interest rates they can offer you.

2. Get Multiple Quotes

Don't just settle for the first lender you come across! Get quotes from at least three different places – banks, credit unions, mortgage brokers, you name it. They all have their own quirks and criteria, so you might be surprised at the variety of offers you get. Trust me, it's worth the extra effort.

3. Use Online Tools and Resources

There are numerous online tools and resources available to help you compare mortgage offers. Websites like LendingTree allow you to receive multiple quotes from different lenders by filling out a single form. Additionally, mortgage calculators can help you understand how different interest rates and loan terms will affect your monthly payments and the total cost of the loan.

Google housing affordability calculator

From Bankrate... Compare 30-year mortgage rates today

This is a nice tool. It gives you today's rate plus a forecast of rate changes on a basis point.

4. Consult a Mortgage Broker

If the process of shopping around feels overwhelming, consider consulting a mortgage broker. Mortgage brokers work with multiple lenders and can help you find the best mortgage rates and terms based on your financial situation. While brokers may charge a fee for their services, the savings you gain from securing a better loan can outweigh this cost.

5. Negotiate with Lenders

Don’t be afraid to negotiate with lenders once you have multiple offers. If you receive a better offer from one lender, ask if your preferred lender can match or beat it. Lenders are often willing to negotiate to win your business, especially if you have a strong credit profile.

Common Mistakes to Avoid

When shopping for a mortgage, there are some common mistakes that can cost you money or complicate the process. Here’s what to watch out for:

Assuming the First Offer is the Best

As the LendingTree study highlighted, many homebuyers accept the first mortgage offer they receive. This can lead to missing out on better rates and terms. Always compare multiple offers before making a decision.

Ignoring Loan Fees and Closing Costs

Interest rates aren’t the only factor to consider when comparing mortgage offers. Pay close attention to loan fees and closing costs, as these can vary significantly between lenders. The loan with the lowest interest rate might come with higher fees, so it’s essential to compare the total cost of each loan.

Not Getting Preapproved

Getting preapproved for a mortgage gives you a better idea of how much you can afford to borrow and shows sellers that you’re a serious buyer. Skipping this step can make it harder to negotiate and may limit your ability to shop around effectively.

Rushing the Process

The homebuying process can be stressful, and it’s natural to want to move quickly. However, rushing through the mortgage comparison process can lead to costly mistakes. Take your time to thoroughly compare offers and ask questions to ensure you understand the terms of each loan.

Emotional Appeal: The Impact of Choosing the Right Mortgage

Choosing the right mortgage isn’t just about numbers and rates; it’s about securing your future and providing stability for your family. Imagine the peace of mind that comes with knowing you’ve made a financially sound decision that will benefit you for years to come. By taking the time to shop around for a mortgage, you’re investing in your family’s future and ensuring you have the financial flexibility to achieve your dreams.

Financial Benefits:

- Lower Monthly Payments: Securing a lower interest rate can lead to significantly lower monthly payments, freeing up more of your income for other expenses or savings.

- Long-Term Savings: Over the life of the loan, even a small difference in interest rates can translate to tens of thousands of dollars in savings.

- Increased Home Equity: Lower interest rates can help you build home equity faster, giving you a more valuable asset.

- Improved Financial Stability: Predictable and manageable mortgage payments contribute to a sense of financial security and peace of mind.

Personal Benefits:

- Reduced Stress: Knowing you have a mortgage that fits your budget and financial goals can reduce stress and improve your overall well-being.

- Ability to Achieve Other Goals: With more disposable income, you can pursue other financial goals, such as saving for retirement, education, or a family vacation.

- Increased Confidence: Choosing the right mortgage empowers you to make informed financial decisions and take control of your financial future.

- Pride of Ownership: Owning a home and building equity can foster a sense of pride and accomplishment.

Personal Stories

Consider the story of Sarah and John, a young couple who recently bought their first home. Initially, they received a mortgage offer from their bank with a 4.5% interest rate. By taking the time to shop around, they found a lender offering a 3.8% rate, saving them over $200 a month on their mortgage payments. Over the life of their 30-year loan, this will save them more than $70,000—money they can now use for their children’s education and family vacations.

So, whether you're a first-time homebuyer or looking to refinance your current mortgage, take Smokey Robinson's mama's advice: "You better shop around." Your wallet—and your future self—will thank you.